BA (Hons) Accounting -(3years full-time)

- 🎓 Category : FACULTY OF BUSINESS

- 🎓 Program : Undergraduate Programs

- 👩🎓 Course Coordinator : Dr. Thein Tan

- This is a franchised Honors program awarded by University of Bedfordshire (UK).

University Of Bedfordshire

About the course

The degree course for you if you seek a career in accountancy or an accounting function in business, and offers the maximum ACCA exemptions available at undergraduate level. Practise using the latest technology, then proceed to advanced study of financial and management accounting, taxation, financial management and auditing.

The Association of Chartered Certified Accountants (ACCA) awards exemptions from its F1 to F9 papers for those students successfully completing relevant units.On completing this course students are likely to progress to work as a Finance Officer , Corporate Accountants, Internal Auditors, Office Administration Assistant, Accounts Professional/Clerk, Appraiser, Bank Compliance Officer A graduate degree can also support further postgraduate study in the field of business, either through a masters qualification, or a PhD.

Method of Assessment

The course will use a range of assessment methods to enhance the student learning experience and improve employability .The assessments will be designed to support the overall course learning outcomes.

Individual Written Reports

Your enterprise is developed and assessed along with your knowledge and skills. You will be required to collect information, evaluate and analyse it, and proceed to conclusion and recommendations in a clear, concise and professional way.

Unseen examinations

Examinations will be set that promote critical thinking, analysis, application, appraisal and synthesis of material to create a more reflective learner.

Coursework assignments

These are designed to help you manage tasks individually over a period of time. They will also assist you in applying and contextualising your knowledge.

Specialist Project Report: A crucial individual piece of work, it provides you with an opportunity to work independently with a supervisor at length, on a topic that particularly interests you. It is also an effective means of research training, which helps to develop advanced intellectual skills such as evaluation, analysis and synthesis, as well as management skills.

Entry Requirement

-

Successful completion of Diploma in Accounting (Level 4) and Advanced Diploma in Accounting (Level 5) awarded by STIMU

-

External applicants with other relevant business qualifications at Level 5 will be assessed on an individual basis according to procedures for the Recognition of Prior Learning (RPL) as set out in the Academic Regulations of STI Myanmar University.

-

Applications will also be welcome from those working in relevant employment who may not fully meet the academic entry requirements but have a number of years relevant work experience and/or hold professional qualifications.

-

Applicants with relevant work experience may be considered on a case-by-case basis for Recognition of Prior Learning (RPL)

-

All entrants to Level 6 will be expected to have achieved a minimum English Language standard of IELTS (5.5 overall, 5 individual) or equivalent qualification

Course Structure

Units

|

Unit Code |

Level |

Credits |

Unit Name |

Core (C) or Option (O) |

|

AAF003-3 |

6 |

30 |

Financial Accounting |

C |

|

AAF002-3 |

6 |

30 |

Auditing |

C |

|

AAF004-3 |

6 |

30 |

Financial Management |

C |

|

AAF016-3 |

6 |

30 |

Specialist Project in Accounting |

C |

Duration – 1 year

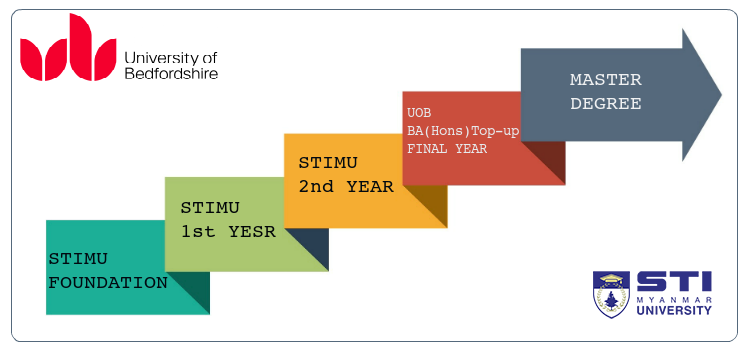

Progression Route

Course Fees

19,200,000 MMK (Course Fees may change without prior notice)